ENTRY - a blockchain-based banking service designed to increase the flow of cryptocurrency in the real economy.

What is ENTRY?

What is ENTRY? ENTRY is a blockchain-based banking service designed to increase the flow of cryptocurrencies in the real economy. It is an AI empowered multi-utility financial platform. ENTRY is designed to allow people to use fiat as well as crypto currencies in their day-to-day purchases without really having to be concerned about the technology behind the system. ENTRY envisions becoming a truly global bank in the post fiat world. Its entire framework is structured to enhance utility of all crypto. ENTRY's suite of products allows it to touch the financial lives of every crypto user and change it for the better.

Why ENTRY?

Why ENTRY? The global financial crisis presents significant weaknesses in the existing financial system and some of the vulnerabilities have already exhibited their impact on the interconnected global market. The world economy is still struggling with sluggish real growth today. Transferring money for remittance, money lending across international borders is still very complicated, time consuming and expensive. Existing systems running on traditional banking channels are slow and full of intermediaries, higher exchange rates, counter-party risks, bureaucracy and extensive paperwork9. ENTRY's business model is focused on disrupting the existing pillars of finance who only act as toll-keepers without providing any value-add to consumers and businesses. Removing the numerous intermediaries would make the system faster,

ENTRY is a blockchain - based platform empowered by smart contracts; it is not the easiest deposit, payment and lending services, cross-border payments, ATM facility / convenient withdrawals, but also as a cryptocurrency exchange for the business and consumer world.

Mission Statement:

Mission Statement: To be the gateway between the traditional and new financial paradigms and systems led by the cryptocurrencies and empower the financial ecosystem to have a framework that allows for interoperability between the two. We aim

To help cryptocurrencies achieve confidentiality and transparency of the world of crypto-finance to every citizen.

To keep a transparent record of all the transactions in the ecosystem.

To expand the use of cryptocurrencies for purchase and payments across the business world.

To create a simple and all-in-one platform to revolutionize the traditional methods of dealing with banking systems.

ENTRY's suite of comprehensive banking products and services will ensure a new benchmark in banking and financial services.

PROBLEM AND MARKET SCENARIO

PROBLEM AND MARKET SCENARIOThe financial crisis of 2008-2009 led the general public to lose faith in the global banking system. Bitcoin, a cryptocurrency developed by a person or a group of people named Satoshi Nakamoto. The loss of trust in the banks led to the emergence of a peer-to-peer "trustless" electronic cash system based on a technology called blockchain.

THE INTERMEDIARY WILL FADE AWAY

THE INTERMEDIARY WILL FADE AWAYThe fundamental value proposition of the blockchain is that it eliminates the need for trust - a commodity without which exchanges of value (transactions) can not happen. This means that individuals and businesses can do away with a whole bunch of intermediaries whom they pay for managing trust. 2

Bitcoin is just one application of the new technology (blockchain). The advent of cryptocurrencies has led to a boom where new innovations are being built on structures through pioneering crypto Tokens to disrupt existing traditional industries.

SURGE IN CASHLESS PAYMENTS

SURGE IN CASHLESS PAYMENTS Global non-cash transaction volumes grew 11.2% during 2014-2015 to reach USD 433.1 billion, the highest growth of the past decade. Debit card and credit card transfers are the leading instruments in 2015, while check usage continues to decline globally. Debit card accounted for the highest share (46.7%) of the global non-cash transactions followed by credit cards with 19.5% in 2015.

The RBR (Retail Banking Research) study shows that the share of credit transfers has also increased. They tend to be used for high-value payments, such as salaries and business-to-business payments, and account for 89% of the value of cashless payments.

The impressive growth of cashless transactions will continue, with cards increasingly being used for low-value payments, supported by the spread of contactless cards and EFTPOS terminals. Meanwhile, growth in credit transfers is being aided by the implementation of systems enabling.

services ENTRY

services ENTRY

Entry.Money

Cryptocurrency business model and fiat payment gateway for e-shops. Personal and business accounts (deposit,

withdrawal, instant cryptocurrency transfer & fiat). Web and Mobile app versions. Debit card.

Cryptocurrency business model and fiat payment gateway for e-shops. Personal and business accounts (deposit,

withdrawal, instant cryptocurrency transfer & fiat). Web and Mobile app versions. Debit card.

Entry.Exchange

Centralized cryptocurrency centralized and ultra-fast and instant p2p. High security standards,

world-friendly services and supported beginners around the world.

Centralized cryptocurrency centralized and ultra-fast and instant p2p. High security standards,

world-friendly services and supported beginners around the world.

Entry.Network

Open source code, wallet, custom blockchain, smart contract, and creation of

platform- specific tokens.

Open source code, wallet, custom blockchain, smart contract, and creation of

platform- specific tokens.

Entry.Bank

Blockchain technology enables fast and uncomplicated cross-border payments at very low cost.

Blockchain technology enables fast and uncomplicated cross-border payments at very low cost.

Entry.Cash Cash

machine / ATM system. Transfer, cash out or top up with cash (using an agent or cash machine).

Payment Gateway for POS (real shop, service provider). It will also look to have a payment card in

the future for easy access to both fiat and crypto.

machine / ATM system. Transfer, cash out or top up with cash (using an agent or cash machine).

Payment Gateway for POS (real shop, service provider). It will also look to have a payment card in

the future for easy access to both fiat and crypto.

Token Entry

Will be used in the ENTRY platform as the main cryptocurrency. Used in other platforms as primary or not

cryptocurrency. Can be traded in exchange.

Will be used in the ENTRY platform as the main cryptocurrency. Used in other platforms as primary or not

cryptocurrency. Can be traded in exchange.

ICO ENTRY

ICO ENTRY

ENTRY Token Details are electronic and virtual currency tokens that will flow in the ENTRY ecosystem. This is the Token currency of the ENTRY platform used for peer-to-peer transactions and micro payments. This will be the medium of exchange for transacting on the platform and utilizing ENTRY's banking and financial services.

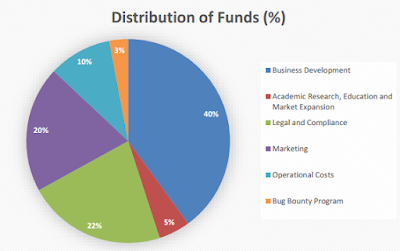

Before the launch of the ENTRY platform, will undergo sales training Token. Funds raised in

ICO will be used by the team to develop the ENTRY platform.

Ticker Symbol ENTRY

Token Background based on ERC-20

Utility Token Type

Sales Date Token 17 April - 17 July 2018 (Temporary)

KYP / AML Required For all ICO of participants before or after

purchase

United States Limited (Please check the laws of your Country previously

Participated )

SOFT CAP 25,000,000 ENTRY / 2.500.000 EUR

HARD CAP 325.000.000 ENTRY / 80,500.000 EUR

Status of the MVP Project Ready

TEAM Ready

License Money Institution Ready

Currency Receive for ICO Fiat Currency: EUR, USD,

Cryptocurrency Debit Card: ETH, BTC, BCH, LTC, DASH

and more

Total ENTRY Coins 590,000,000 million

ICO will be used by the team to develop the ENTRY platform.

Ticker Symbol ENTRY

Token Background based on ERC-20

Utility Token Type

Sales Date Token 17 April - 17 July 2018 (Temporary)

KYP / AML Required For all ICO of participants before or after

purchase

United States Limited (Please check the laws of your Country previously

Participated )

SOFT CAP 25,000,000 ENTRY / 2.500.000 EUR

HARD CAP 325.000.000 ENTRY / 80,500.000 EUR

Status of the MVP Project Ready

TEAM Ready

License Money Institution Ready

Currency Receive for ICO Fiat Currency: EUR, USD,

Cryptocurrency Debit Card: ETH, BTC, BCH, LTC, DASH

and more

Total ENTRY Coins 590,000,000 million

Roadmap

Roadmap

Development 2015-Get started and earn a Money Institution License.

The 2017 agreement-signed with the central bank to obtain SWIFT and IBAN numbers to link the SEPA system of the European Union.

2017-Developed payment gateway (credit / debit cards, bank links and more) to raise funds for online stores.

Integration 2017-Started with the Central Bank system to provide peer-to-peer payments to all EU banks and start building infrastructure for international payments.

The crypto-exchange and beta 2017-Start versions will be ready before ICO or during ICO.

2017-Hold meetings with card issuers for MasterCard or Visa card issuing to ENTRY users and invest more than 1 million Euros for sustainable platform development.

2018 (1st through 3rd Quarter) - Begin developing Pre-ICO and ICO. During ICO we will launch a payment gateway (ENTRY.MONEY) with a bank account for personal use. We will launch a crypto exchange (ENTRY.EXCHANGE).

2018 (4th Quarter) -Financial Institution license form (already obtained) for Electronic Money License or European Bank License. Begins obtaining financial licenses outside the EU to operate worldwide.

Service 2019 (2nd Quarter) -Expand (ENTRY.MONEY) adds business accounts worldwide apps and launches.

2019 (3rd Quarter) -Stop (ENTRY.NETWORK) wallet to store, send, receive your crypto, participate in ICO via wallet. Blockchain (self or partners).

2019 (4th Quarter) - Starts P2P Loan (ENTRY.BANK).

2020 (2nd Quarter) - Launch ATM System (ENTRY.CASH) and install cash machine for beta testing.

2020 (3rd Quarter) - Partner with agents to provide deposit and withdrawal services with cash.

2021 (continued) - Investment, loans and other banking and financial services worldwide.

The 2017 agreement-signed with the central bank to obtain SWIFT and IBAN numbers to link the SEPA system of the European Union.

2017-Developed payment gateway (credit / debit cards, bank links and more) to raise funds for online stores.

Integration 2017-Started with the Central Bank system to provide peer-to-peer payments to all EU banks and start building infrastructure for international payments.

The crypto-exchange and beta 2017-Start versions will be ready before ICO or during ICO.

2017-Hold meetings with card issuers for MasterCard or Visa card issuing to ENTRY users and invest more than 1 million Euros for sustainable platform development.

2018 (1st through 3rd Quarter) - Begin developing Pre-ICO and ICO. During ICO we will launch a payment gateway (ENTRY.MONEY) with a bank account for personal use. We will launch a crypto exchange (ENTRY.EXCHANGE).

2018 (4th Quarter) -Financial Institution license form (already obtained) for Electronic Money License or European Bank License. Begins obtaining financial licenses outside the EU to operate worldwide.

Service 2019 (2nd Quarter) -Expand (ENTRY.MONEY) adds business accounts worldwide apps and launches.

2019 (3rd Quarter) -Stop (ENTRY.NETWORK) wallet to store, send, receive your crypto, participate in ICO via wallet. Blockchain (self or partners).

2019 (4th Quarter) - Starts P2P Loan (ENTRY.BANK).

2020 (2nd Quarter) - Launch ATM System (ENTRY.CASH) and install cash machine for beta testing.

2020 (3rd Quarter) - Partner with agents to provide deposit and withdrawal services with cash.

2021 (continued) - Investment, loans and other banking and financial services worldwide.

For more information visit the following link:

For more information visit the following link:- Website: https://entry.money/

- WhitePaper: https://entry.money/ENTRY_Whitepaper_v1.pdf

- Ann thread: https://bitcointalk.org/index.php?topic=3229958.0

- Twitter: https://twitter.com/EntryMoneyICO

- Facebook: https://www.facebook.com/entrymoney/

- Reddit: https://www.reddit.com/r/EntryMoney/

- Linkedin: https://www.linkedin.com/company/entry-money/

- Whatsapp: https://chat.whatsapp.com/BUkzyIMqew3Gx7G40HVa70

- Telegram: https://t.me/Entry_Official

AUTHOR.

AUTHOR.- Bitcoinalk username: Cintashany01

- Profile link: https://bitcointalk.org/index.php?action=profile;u=1661845

- Facebook: https://www.facebook.com/max.bebasmardeka

- Twitter: https://twitter.com/tarjoe_maximum

- Telegram username: @TarjoeMaximum

- ETH adress: 0x2b53a131742A8d2a03771C168267888D7ed5974f

Tidak ada komentar:

Posting Komentar