WHAT IS VIVA NETWORK?

Viva Network is a decentralized mortgage lending platform which enables borrowers and investors to innovate and meet directly in 1 place safely and safely. The Viva platform has been encouraged by cutting edge blockchain technology therefore that between investors and borrowers can create trades without the need for intermediaries or government hindrance. By applying the device manufactured by Viva, the entire financing process will run more safely, efficiently and economically.

Viva will be used to create a brand new market in the lending/mortgage industry. The objective is to decrease the inefficiencies the has while rendering it less expensive to buy homes.

This can be the fist period, Viva enables private investors who are accredited To purchase high-end profitable, advantage orients FMS (Fractionalized Mortgage Shares). This also will help to innovate applications that have been built to increase the current state and conventional credit rating and appraisal procedures, frequently time outdated.

Viva is just a transformative economic technology which introduces large scale property mortgage lending to the world. Viva’s platform will utilize wise contracts to crowdfund home loans, connecting borrowers and investors directly in just a decentralized, trustless ecosystem. By leveraging ultra-secure blockchain trades, Viva cuts out the middlemen, resulting in a lending process which is more profitable and efficient for all parties.

Viva enables a free market to ascertain the interest rate on a borrower’s mortgage and removes the dependence on banks and other financial intermediaries. By eliminating inefficiencies in local financial techniques, mortgage rates will more fairly and accurately reflect the level of danger related to the asset’s actual value.

THE WAY VIVA NETWORK WORKS?

The system is worked on a borderless and decentralized funding Company for home loans that’s been developed to eliminate the necessity to rely on middlemen like financial institutions and banks also financial intermediaries.

Innovation is the key to Viva, the financial technology used on the System is intentionally utilized to attract larger decentralized mortgages to The folks of the planet.

The platform initiates smart contracts for use Of funding mortgage loans during crowdsales. And it connects the Investors with the borrowers p2p on the decentralized, trustless technician platform. Leveraging the blockchain unbeatable safety is your key to huge trades. And by cutting out the middleman like Viva does, the Lending procedure gets more profitable than before.

The business enables the free market to Select the going interest rate a Mortgage takes for the borrower. The need to have a bank or alternative Financial service middleman is eliminated through the procedure and can be local financial institutions. Fees on the Home Loans will become more powerful, representing the risk related to that accurately in accordance to the assets true value.

When the banks failed in 2008 they brought with them one of the world’s first cryptocurrencies and started the process of decentralizing financial conglomerates power. Viva is currently looking for approaches to finish the process, thereby carrying all energy in the older, conventional and completely outdated financing systems — to leave them previously, where They’ve belonged for a very long moment.

Viva will tackle the problems in mortgage financing direction for Example, as the vast majority of the world’s population will not have fair access to charge, with a decentralized mortgage lending platform supported By blockchain technology.

The Viva network will simplify and simplify The mortgage financing process and allow it to be profitable for every Participant. The mortgage specifically for home financing that was Previously an issue for everybody else, has now gotten rewarding and easier

TECHNOLOGY

Blockchain-oriented

Mission-critical info, transactions and appraisals will be endorsed by blockchain technology. Ethereum intelligent contracts and BigchainDB at our Core empower decentralization in an extremely stable, resilient, transparent, and trust-less atmosphere.

Robust Microservice APIs

Built by software engineers specializing in architecting large scale Financial enterprise systems, also a RESTful service oriented architecture will allow the Viva Network to adapt to changing industry trends and chances with ease.

3rd Party FinTech Integration

Built to accelerate alternate finance trends by seeking integration with complimentary suppliers from credit rating to generalized blockchain strength portfolios.

AI/ML Constructed

Embracing Machine Learning abilities to provide insights and Tips, The Viva Network will enable clients like never Earlier, from risk classification to fractionalized mortgage portfolio Finance placement and selection.

Cloud Scalability

Built to harness elastic cloud scalability through containerization in Preparation for large scale adoption of this stage, this may enable Low Latency, high-throughput fractionalized mortgage trading using high Availability.

Bigdata Ready

The Viva Network Platform will utilize AWS For an infrastructure capable of processing vast amounts of loan, Real estate, and trading pattern data sets for machine-learning analytics. That will evolve a uniquely intelligent platform.

HOW IT WORKS VIVA NETWORK

TOKEN GENERATION EVENT DETAILS

Hard Cap Generation Token Generation: 3,000,000,000 VIVA tokens

Pre-Sales

Hard-cap ETH: 6.870 ETH

Pre-Sales 1

Bonus tokens: 40%

ETH lift hard-cap: 500 ETH

Pre-Sales 2

Bonus tokens: 35%

ETH raised hard-cap: 2,570 ETH

Pre-Sales 3

Bonus tokens: 30%

ETH Hard-cap lifes: 6,870 ETH

DISTRIBUTION TOKEN

Total number of tokens: 4 billion VIVA

75% – Token Generation Event

7.5% – Team Allocation

3.75% – Advisory Allocation

10% – Fund Reserve Allocation

3.75% – Allocation of Marketing Contribution, Bounty, and Private

ROADMAP

May 2016 – Inception of original idea.

June 2017 – Exploration of the blockchain ecosystem to identify appropriate core technologies.

July 2017 – creation of service-oriented architecture from Viva Platform.

August 2017 – Exploration and feasibility analysis data.

Nov 2017 – Developing Value Assessment Algorithm 1.0.

Q1 & Q2 – 2018 – Launch of Generation Token Events and MVP development. Start Hands large-scale campaign.

Q3 – 2018 – Develop Real Value 2.0 Application. • Legal and regulatory licenses.

Q4 – 2018 – Launches the Real Value 2.0 application. Finalization of exclusive ML algorithms.

Q1 – 2019 – Starts stepping on the Viva Network Platform.

Q2 – 2019 – Launches Viva Network Platform and successful first home loan crowdfund with Viva mortgage financing system.

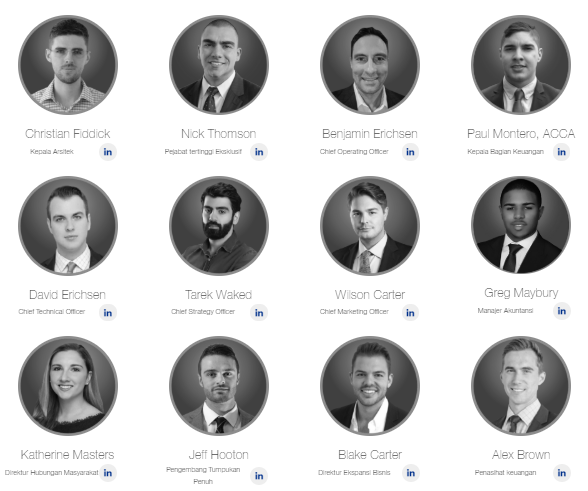

TEAM

MORE INFORMATION VISIT THE VIVA NETWORK LINK:

Website : http://www.vivanetwork.org/

Whitepaper : http://www.vivanetwork.org/pdf/whitepaper.pdf

ANN Thread : https://bitcointalk.org/index.php?topic=3430485

Facebook: https://www.facebook.com/VivaNetworkOfficial/

Twitter : https://twitter.com/TheVivaNetwork

Reddit : https://www.reddit.com/r/TheVivaNetwork/

Github : https://github.com/viva-network/viva-tge

Medium : https://medium.com/@VivaNetwork

Telegram : http://t.me/Wearethevivanetwork

Author of the article:

Bitcoinalk username : Cintashany01

Profile link : https://bitcointalk.org/index.php?action=profile;u=1661845

Facebook : https://www.facebook.com/max.bebasmardeka

Twitter : https://twitter.com/tarjoe_maximum

Telegram username : @TarjoeMaximum

ETH adress : 0x2b53a131742A8d2a03771C168267888D7ed5974f

Tidak ada komentar:

Posting Komentar