AFRICUNIA (AFCASH) - Digital Bank based on the Blockchain Technology.

AFRICUNIA’s primary goal is to become the industry standard and a one-stop shop for setting up tokenized funds, regardless of whether these funds invest in the fiat or crypto universe.

- AFRICUNIA BANK — The 1st African Blockchain Technology 3.0 & Cryptocurrency

- Develops the 1st Hybrid (Proof-of-work + Proof-of-Stake) Blockchain Technology in all programming languages

- Develops browser-based and bon browser-based Blockchain Technology

- Develops the world’s 1st Crypto-based PoS (Point of Sale)

- Launches AFCASH ICO 1st January 2018 till 31st March 2018.

Remember Bitcoin, the crypto currency that not too long ago had taken the world by storm and is today a perfect fit in the prevailing digital environment?

Well, now here is another cryptocurrency that will surely shake up the financial world. Welcome to the world of AFRICUNIA which basically means African money. This forward thinking group is registered in the United Kingdom as AFRICUNIA Limited under the UK Government’s Standard Industrial Classification (SIC) for Banks and Financial Services, and led by a young visionary leader in the person of D. Chancellor F. Nzenwa. The “CUNIA” in “AFRICUNIA’ comes from the Latin word “PERCUNIA” meaning “money” or “cash.” whereas “AFRI” is the abbreviated version of AFRICA.

Therefore translated — AFRICUNIA means African Money or African Cash.

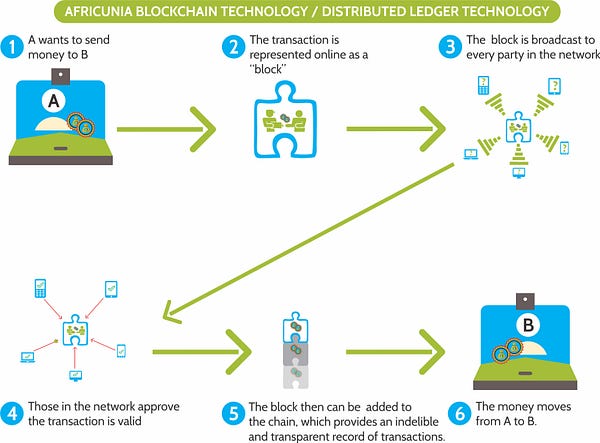

The focus of AFRICUNIA is to usher in an age of transparency and decentralization in the fiscal world that will touch new horizons by bridging the gap between paper money and the virtual world of digital currencies. Operating on the rock solid foolproof system of the Blockchain Technology platform, AFRICUNIA promises to offer a wide range of solutions from technology and infrastructure to corporate structuring and legal compliance.

What does AFRICUNIA bring to the table that facilitates banking and other value added transactions?

AFRICUNIA is the First 100% Fully Digital Crowdfunded African Open Bank- a Digital Bank based on the Blockchain Technology.

AFRICUNIA as a new and unique Financial Institution is going to offer not only traditional banking services such as opening of savings & current accounts, issuing of debit & credit cards, loans and forex exchange services but also will provide innovative services like bank-to-bank transactions, interconnecting the world of traditional finance and cryptocurrency startups.

AFRICUNIA BANK will become a fully digital bank that is accessible everywhere, 24/7. It will function just like a conventional bank, but will not host any branches nor any physical front-offices.

For one, just like traditional channels of banking such as SWIFT and BIC, AFRICUNIA ensures speed, efficiency and low-cost bank settlements and payments. This will also enable banks to transfer money across international borders in real time without having to go through traditional time absorbing multiple layers of fiscal networks. Further, AFRICUNIA incorporates all the requirements of modern day banking such as advanced technological innovations and Blockchain Technologies while making sure that all regulatory and safety norms are strictly adhered to.

Coming to the environment that is not banking per se but intricately linked to the world of finance, trade and commerce, AFRICUNIA has a crucial role to play here. It is the World’s first crypto-based POS (Point of Sale) and a digitized system that focuses on bringing instant solutions to industries seeking financial and industrial services. AFRICUNIA has highly developed secured wallets options ranging from offline wallets to online wallets to smart wallets. The cryptocurrency also has in-built systems that ensures that all AML/KYC protocols are strictly adhered to, thereby being within the ambit of legal rules and regulations of the banking community.

D. Chancellor F. Nzenwa summarized the goal of AFRICUNIA as follows “It is to bring together the real tangible currencies of the world and the optimized advantages of cryptocurrency so that both benefit greatly from it“

Africunia is the First 100% Fully Digital Crowdfunded African Open Bank- a Digital Bank based on the Blockchain Technology.

Africunia as a new and unique Financial Institution is going to offer not only traditional banking services such as opening of savings & current accounts, issuing of debit & credit cards, loans and forex exchange services but also will provide innovative services such as bank-to-bank transactions, interconnecting the world of traditional finance and cryptocurrency startups.

Africunia Bank will become a fully digital bank that is accessible everywhere, 24/7. It will function just like a conventional bank, but will not host any branches nor any physical front-offices

The Blockchain Technology universe is fast becoming part of our DNA. Believe it or not it’s going to be predominantly how we move cash from one point to another, how we share our experiences, how we consume our entertainment, how we stay in touch with our loved ones and how we do our daily businesses and activities.

Take a look at how we used to study, to travel, to make phone calls, shoot movies, send faxes and mail our correspondences in the past.

Since its launch in 2009, the Blockchain Technology together with its underlying technologies has triggered tech and social revolution waves that have sent ripples across a horde of industries. Today, it is not just the financial sector that is using the Blockchain Technology, but other industries such as Healthcare Providers, Insurance Companies, Governments, and IoT. The applications using the Blockchain Technology seem limitless.

One thing is for sure: the Blockchain Technology is here to stay just as the internet has over the past two decades. But amidst the hype about the Blockchain Technology and the digital currencies, their adoption in the mainstream financial industry has been disastrous.

Already, several banks have started to develop a foolproof methodology and standards that align the technology with responsible innovation. In 2016, IMF and the World Bank held a conference that was hosted by the U.S Federal Reserve where an estimated 90 Central Banks committed themselves to researching into Distributed Ledger Technology (DLT), the Blockchain and the digital currencies to create a responsible digital currency.

AFRICUNIA BANK is an innovative Banking Technology created to build Digital Currency and financial investment.

Africunia introduces an innovative banking model that enables the use of digital currencies without the risks and technical barriers associated with ownership of transfer and crypto and token trade. During ICO africunia is open to investing. Africa is a third generation closed-end fund using Blockchain. Technology for creating banks and peet-to-peer cryptocurrenci called Afcash. If ICO succeeds Africunia will become a digital financial institution that can be accessed anywhere. Africa will function like a conventional bank, but not host any branch also has a physical office. In other words, AFRICUNIA is a virtual bank that will issue AFCASH using AFRICUNIA Blockchain 3.0 Technology. In fact, AFRICUNIA creates a lost relationship between conventional and world-class economies that are dominated by blockchain 3.0.Our main goal is to become the industry standard and one stop shop to set up token funds, regardless of whether those funds are investing in fiat or crypto nature. We intend to bridge the gap between these two worlds while taking advantage of both worlds.

Excess Africunia.

Excess Africunia.

1. Offer the best cryptocurrency from the Fiat world. The majority of tokenized investment platforms are completely cryptooriented or pegged to some tradable assets such as gold or currency fiat. This siled approach hampers diversification. AFRICA intends to create the platform for users to benefit from both including decentralization, transparency, and exchange rates.

2. Promote sustainable fund investment. All token funds will be reviewed and approved by our advisory laws to ensure they are fully compliant with existing laws and regulations. By sifting through these risks from the start, AFRIKA will increase investor confidence and offer the necessary sustainability investment.

3. Develop a standard platform. Setting up the right investment structure is a difficult and costly undertaking. Not all tokenized funds set up have the appropriate structure, thus increasing regulatory risk for investors. AFRICA believes that this is a great time to launch industry standards to set up tokenized investment platforms.

4. Enhanced transparency Signature of the interest of the fund — or part of the profits provides accountability and transparency of the investment process. The required transparency will significantly improve the accountability of the investment manager.

5. Developing measurable funds. By using the AFRICUNIA platform, approved investment managers will set up and run token investment funds with no constraints and required IT development efforts and legal infrastructure.

Profits for investors

Profits for investors

Advantages for crypto investors:

• New opportunities to access assets from the universe of fiat without leaving the crypto universe to be comforted.

• Unprecedented diversification opportunities due to the low correlation between fiat and crypto assets.

• Access to investment opportunities that can lower the risk profile to complement and balance existing speculative exposures.

Benefits for fiat investors:

• Provision of higher net returns, cost-effective for tokenized fund structures

• Access to new asset classes due to lower barriers to a prepared fund and administration on the Africunia platform.

APCA

Our technology will be based on AFRICUNIA PROTOCOL CONSENSUS ALGORITHM (APCA). While APCA will incorporate the following components:

• Server . The server will be the entity that runs the AFRICUNIA Server software that facilitates the consensus process.

• Ledgers . The ledger contains a record of the number of AFCASHs in each user account and will be updated periodically on the network.

• The Last Closed Ledger : The last closed book will be the latest ledger that has been confirmed by the consensus process and represents the current network status.

• Open Ledger : The open ledger will be the current operation status of the node.

How to participate in ICO

We will allow participants to invest using the following methods:

• Purchase a direct credit card or debit card to be cashed in website

• Using NAIRA, USD, EURO, and POUNDS STERING fiat currency using Debit Card / Credit Card and SWIFT transfer.

• Purchase directly on the platform of our website by using

The Fund Structure

The Fund Structure

The fund structure may differ from one case to another. While it will evolve as new information becomes available, it will be run by a reputable legal counsel that will keep an updated reviews of what has been published.

Here is how the tokens will be divided:

- The public contributors will be allocated 50% of the AFCASHs.

- The company reserve will be assigned 30% of the AFCASHs. The reserve will form part of the company’s source income after the distribution period and will be allocated on a partial basis among the direct contributors and the core team of the business where necessary.

- The remaining 20% of the AFCASHs will be allocated to the Founding Africunia Members and its advisors, partners, and campaigners as follows: 15% (Africunia Founders); 3% (Advisors & Partners); 2% (Campaigners). These funds would not be immediately tradable in order to continue motivating the core team after the distribution period.

Vision

Vision

vision for the new standard of tokenized investment platforms that will help to bridge the gap between the fiat and the crypto universes. At its core, Africunia will focus on all aspects of tokenized investment vehicles ranging from technology and infrastructure to legal compliance and the corporate structuring.

Technologies

Technologies

To remain within the limits of conventional banking, we will use the API (Authorized Payment Institutions) therefore employing the appropriate standards of services and innovation.

The basis of AFRICUNIA BANK is capital invested increasing in accordance to the customer development in turn maximizing profit return. Also, as far as our technology security is concerned our network architecture is decentralized. Therefore, data storage, cryptograph encryption and security mechanism for identification, authentication and authorization of individuals or companies are connected by instruments. Nevertheless, processing of data is automated by means of applied AI algorithms.

Our value

Our value

Our primary goal is to become the industry standard and a one-stop shop for setting up tokenized funds, regardless of whether these funds invest in the fiat or crypto universe

- Offering best of both Fiat and Cryptocurrency world

- Promoting sustainable investment of funds

- Developing a standardized platform

- Enhanced transparency

- Scalable fund development

- Market leading compliance

- Development of a standard platform

ICO Token Detail

ICO Token Detail

Token details token/coin symbol: afcash

Token/coin total supply: 500,000,000 (five hundred million afcashs)

Circulating supply: 500,000,000 (five hundred million afcashs)

Token/coin price: 1 afcash = $0.10 usd

Unsold tokens: any unsold token will be burnt

Sharing revenue: at the end each financial year, 20% of africunia bank’s profit will be distributed among all holders of our token (afcash) based on each holder’s share of total amount of tokens issued, and this will be automatically paid out to our coin users in their respective wallets. In other words, you are entitled to africunia bank’s revenue. Consider this as a passive income.

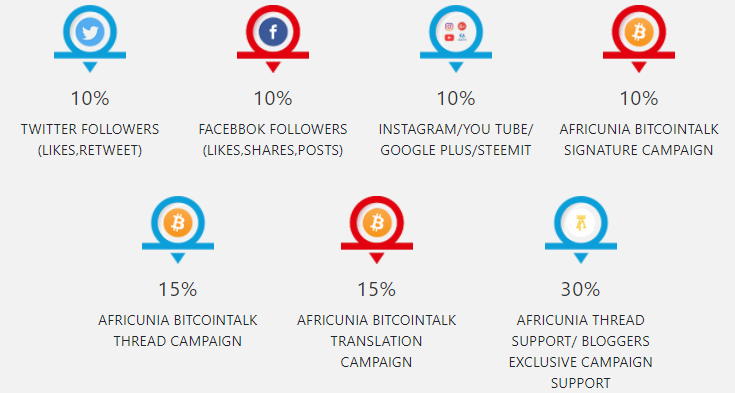

Bounty Campaign Reward Structure

Bounty Campaign Reward Structure

RoadMap

RoadMap

July 10, 2017 to January 1, 2018Research & Experiment, Researching and experimenting with APCA will be our first step in Africunia Journey.Our developers will develop a prototype dummy Blockchain system based on APCA and test it for the truth, consensus and utility. We’ve researched and experimented with APCA and its applications in Blockchain. This phase will run until January 1, 2018.

1 De sember 2017 to 31 December 2017PRE-ICO, AFCASH Pre-order will open on December 1, 2017 and run for 4 weeks until 31 December 2017. We are targeting BOTOGRAFT 10 Billion tokens with annual inventories of 1 Billion over the next 10 years. January 1, 2018 to February 28, 2018 ICO

ICO ICO AFCASH will commence on 1 January 2018 and run for 2 months until 28 February 2018.

March 1, 2018 to March 31, 2018. Development of prototype blockchain. At this stage, we will develop a Blockchain prototype that will help eliminate ambiguity and improve accuracy with our AFCASH crypto. We expect this step to take 4 weeks and will run from 1 March 2018 to 31 March 2018.

April 1, 2018 to April 30, 2018. Development of blockchain beta version. A beta version of our AFCASH crypto will be developed to help developers understand the ecosystem better because further ambiguity is eliminated. We hope this phase will take up to 4 weeks. Therefore, this phase will run from April 1, 2018 to April 30, 2018.

May 1, 2018 to May 21, 2017 . ecosystem testing. We will test the system as a whole and make sure it works well and can be operated with the existing system. This stage will take up to 3 weeks and will run from May 1, 2018 to May 21, 2018.

May 31, 2018. Complete development of blockchain technology. We expect complete Blockchain Technology to be completed on May 31, 2018.

June 1, 2018. Launch blockchain and ecosystem. We look forward to launching the Blockchain Ecosystem on June 1, 2018.

June 2018. Solidification and technology expansion. After the launch on June 1, the project will undergo continuous maintenance and development to handle all of the Science and Technology, Machine Learning and major data issues.

For More Information About Africunia :

For More Information About Africunia :

Website : https://africunia.com/

Whitepaper : https://africunia.com/wp-content/uploads/2018/02/AFCASH-Whitepaper.pdf

ANN : https://bitcointalk.org/index.php?topic=2847593

Bounty : https://bitcointalk.org/index.php?topic=2875357.0

ANN : https://bitcointalk.org/index.php?topic=2847593

Bounty : https://bitcointalk.org/index.php?topic=2875357.0

Facebook : https://www.facebook.com/africunia

Twitter : https://www.twitter.com/africunia

Telegram : https://t.me/africunia

Slack : https://africuniabank.slack.com

Medium : https://medium.com/@africunia

Instagram : https://www.instagram.com/africunia

Youtube : https://youtu.be/SOfxwaB5b2U

AUTHOR.

AUTHOR.

Bitcoinalk username : Cintashany01

Profile link : https://bitcointalk.org/index.php?action=profile;u=1661845

Facebook : https://www.facebook.com/max.bebasmardeka

Twitter : https://twitter.com/tarjoe_maximum

Telegram username : @TarjoeMaximum

ETH adress : 0x2b53a131742A8d2a03771C168267888D7ed5974f

I have read this post. collection of post is a nice one..!!..Keep Update and Learn more detailed information through the Blockchain Online Course

BalasHapus